Welcome to Levva: An Evolution into the Next Era of Simple and Effective DeFi

DeFi has grown exponentially, bringing innovative applications that are reshaping financial markets and redefining the accessibility of digital assets. In this landscape of rapid development, Levva is emerging as the next evolution of Marginly, set to simplify capital management, boost accessibility, and increase rewards for DeFi users. This change addresses challenges in Decentralized Finance (DeFi), tackling capital fragmentation and the inherent inefficiencies across varied protocols. Through Levva, we’re committed to empowering users—whether yield-hungry degen farmers or conservative institutional investors—to navigate DeFi’s complexity with confidence and ease.

In this article, we’ll dive into the journey from Marginly to Levva, explore the issues that Levva is solving, and provide insights into how this evolution benefits both liquidity providers and borrowers.

The Journey from Marginly to Levva: Why Now?

The shift from Marginly to Levva was driven by a vision to provide a holistic, user-centric experience in DeFi capital management. Marginly has already established itself as a key player in DeFi liquidity management, offering isolated lending markets that have made it easier to engage in capital-intensive activities without and centralized constraints. However, as DeFi continues to mature, user needs have also expanded. The ability to move capital efficiently, earn a reliable yield, and avoid fragmentation across networks has become a critical challenge to solve in order to retain a more sophisticated user base.

Levva builds upon the achievements of Marginly, addressing fragmentation and enhancing yield accessibility via a platform that centralizes and optimizes liquidity management. With this evolution, Levva is ready to propel DeFi into its next phase by providing both new and existing users with access to advanced yield generation, automated rebalancing, and a simplified user experience. This evolution combines Marginly’s familiar functionality under the Levva brand and adds layers of innovation that make capital management more efficient and rewarding.

The Problem: Capital Fragmentation in DeFi

While DeFi has transformed the landscape of digital finance, two primary challenges remain: capital fragmentation and inefficient capital movement across protocols. Here’s a closer look at each:

Capital Fragmentation

Capital fragmentation arises from the existence of isolated blockchain networks that cannot seamlessly communicate with one another. As more blockchain ecosystems develop, liquidity becomes scattered across different networks and protocols, creating obstacles for users who want to access a single marketplace. Each blockchain has unique consensus rules and design choices that make interoperability difficult, which prevents liquidity from being fully accessible and integrated.

Inefficiencies in Capital Movement

DeFi investors often find it challenging to move and rebalance capital quickly due to fragmentation and the distinct characteristics of each blockchain and protocol. Traditional methods of manually rebalancing capital across DeFi protocols are cumbersome and require users to keep constantly engaged. These inefficiencies are particularly evident in fast-moving markets, where every second counts.

Addressing these challenges is essential for creating a mature DeFi ecosystem that can cater to a broad user base—from high-risk degen yield farmers to institutional investors who require more stable, predictable yields. Marginly and Levva were developed with these issues in mind, and the combination of these platforms aims to deliver a solution that maximizes utilization across DeFi use cases.

How Levva Solves Fragmentation and Unlocks Capital Efficiency

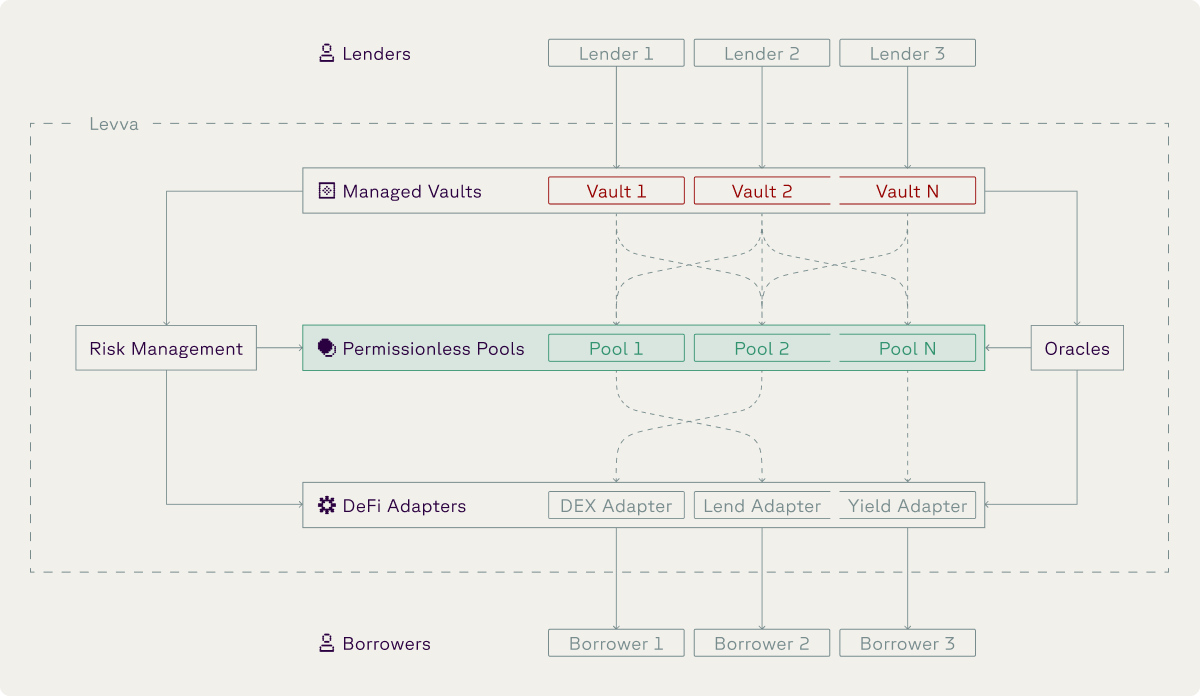

Levva enhances the foundational technology of Marginly to create a more advanced DeFi experience. Building on Marginly’s initial focus–like boosted yield farming across top DEXes and AMMs—Levva adds a protocol layer and optimized infrastructure that includes smart vaults for automated yield generation. These vaults dynamically allocate liquidity across top DeFi protocols, removing the need for constant manual rebalancing, and helping users maximize their earnings.

What Are Levva Vaults?

Levva’s vaults represent a new layer of sophistication in DeFi. Designed as ERC-4626 compliant vaults, these support single-asset deposits and incorporate automated strategies for maximizing yield. Here’s how Levva vaults work:

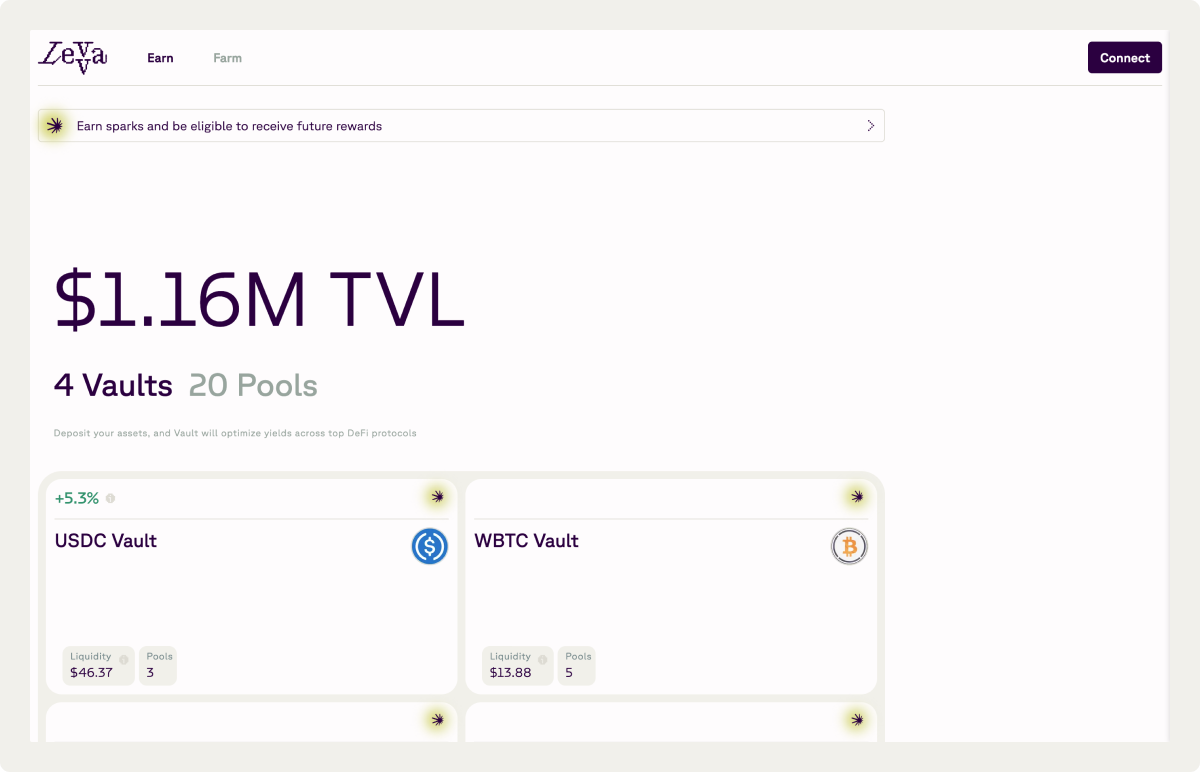

Single Asset Deposits: Users can deposit a single asset, such as ETH or WBTC, into a vault. This allows users to maintain a simplified portfolio while still benefiting from diversified yield opportunities across multiple DeFi protocols.

Automated Yield Generation: Levva’s smart vaults dynamically distribute liquidity across protocols like Uniswap, Curve, and Pendle. By automating this allocation, Levva ensures that capital is deployed efficiently, maximizing yield without requiring users to monitor and rebalance their positions constantly.

Liquidity Concentration: The vaults pool liquidity and allocate it based on current market conditions. This setup enables Levva to concentrate liquidity inside each vault, directing it toward high-yield opportunities based on real-time demand.

Roles Within Levva Vaults

Levva’s vaults operate with two main roles: customers and vault managers.

Customers: Public users who deposit liquidity into the vaults to earn passive income. Their earnings are reflected through the appreciation of the Liquidity Provider (LP) token, which represents a share of the vault’s asset base.

Vault Managers: Responsible for selecting approved pools and DeFi protocols for liquidity allocation, vault managers can be automated to ensure efficient, hands-free management. For example, the initial vaults will feature an automated manager to adjust portfolio allocations based on target yield goals.

Leveraging Automation for Optimal Performance

Levva introduces an advanced level of automation to its vault management, making it possible to adapt allocation strategies based on market demand and target yields. For example, consider a WBTC vault that automatically distributes capital among various farming pools. The manager can dynamically adjust allocations based on changes in market conditions, ensuring liquidity is optimized and yield generation remains steady.

To maintain optimal allocation, Levva’s vaults monitor demand across connected pools and rebalance holdings periodically. This feature ensures the vault’s portfolio adheres to a set yield target, adapting to fluctuations in demand without needing manual intervention.

Levva’s vaults are secure and have undergone three rigorous audits, including a recent audit from Hashlock, which assessed and approved their security and functionality. With these audits in place, users can engage with Levva’s vaults confidently, knowing that their assets are well-protected.

A Closer Look: Benefits for Liquidity Providers and Borrowers

The evolution of Marginly to Levva provides benefits for two primary groups: liquidity providers and borrowers.

Liquidity Providers

Levva offers liquidity providers a unique way to participate in DeFi with reduced risk and optimized returns. Here’s how it works:

Automated Yield Farming: Liquidity providers deposit assets into Levva’s smart vaults, and Levva takes care of yield farming, automatically allocating capital to the most promising pools and protocols.

Diversified Exposure: Levva vaults spread exposure across a range of high-performing DeFi opportunities, providing liquidity providers with diversified and competitive yield-generation options.

Set-and-Forget Income: With Levva’s automated interest accrual and compounding, liquidity providers can earn a passive income without needing to actively manage their portfolios.

Default ETH and USD Yields: Liquidity providers can earn ETH and USD staking yields by default, which further boosts the appeal of Levva as a source of dependable yield.

For Borrowers

Levva’s smart contract technology also serves a variety of borrowing needs, allowing users to access liquidity for yield farming and other investment strategies. Levva borrowers benefit from:

Boosted Farming Rewards: Levva offers boosted farming options, enabling borrowers to borrow assets with the potential to earn up to 70% higher rewards than traditional strategies.

Delta-Neutral Strategies: For more advanced users, Levva provides opportunities to create delta-neutral positions, allowing users to hedge risks and achieve steady returns.

Borrowing Options: Borrowers can borrow ETH or stablecoins against various types of collateral, expanding their options for portfolio leverage and liquidity management.

How Will This Affect Current Marginly Holders and Liquidity Providers?

Existing Marginly holders and liquidity providers will experience a seamless transition to Levva. Liquidity in pools will remain as it is, with plans to ensure users yield generation is uninterrupted. Points and rewards earned in Marginly will also transfer to Levva’s updated reward system, enabling users to capitalize on enhanced earning opportunities. This migration provides liquidity providers with a simple interface that offers automated vault management, cross-chain capabilities, and the option to earn boosted rewards.

Levva’s Vision: Building Omnichain Liquidity Management for the Future

Levva isn’t just about optimizing DeFi for today; it’s about creating a foundation for the future. Levva envisions a world where liquidity flows seamlessly across blockchains, allowing users to engage in yield generation regardless of the chain they choose. Our roadmap includes the following innovations:

Cross-Chain Liquidity Optimization: We aim to develop solutions that allow liquidity providers to earn yield without being confined to a single blockchain.

Decentralized Vault Management: Levva will explore decentralized options for vault management, leveraging third-party services like EigenLayer to power more efficient portfolio rebalancing and risk management.

Expanded Adapter and Oracle Support: We plan to integrate additional adapters and oracles, which will allow users to access more diverse yield strategies, including delta-neutral stablecoin positions and other low-risk opportunities.

Levva—Redefining Capital Management in DeFi

Levva represents the next evolution in DeFi, empowering users with a platform that combines Marginly’s foundational strengths with new tools for optimized capital management. By tackling fragmentation and simplifying liquidity movement, Levva makes DeFi more accessible to everyone—from high-yield farmers to risk-averse investors. Through smart vaults, cross-chain capabilities, and rigorous security, Levva is creating a pathway to the future of decentralized finance. Whether you’re an experienced DeFi user or just starting, Levva is here to make yield farming, lending, and borrowing simpler.