Understanding Risk in DeFi — Fundamentals for Vault Selection

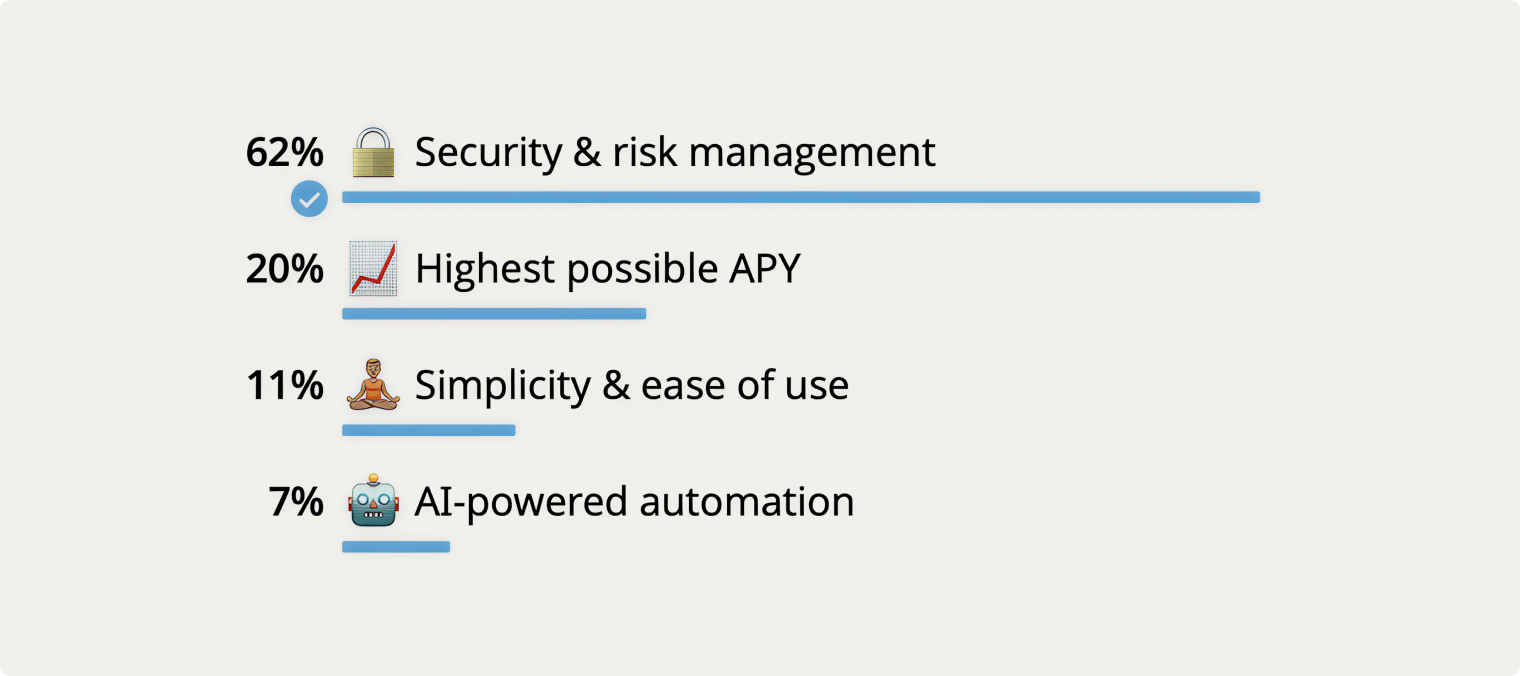

In a recent poll of our community, 62% of users identified security and risk management as their top priority when selecting a DeFi vault. This overwhelming response makes perfect sense: in the volatile world of cryptocurrency, understanding and managing risk isn't just desirable—it's essential for survival.

But what exactly constitutes "risk" in DeFi, and how can we measure it meaningfully? More importantly, how can these measurements guide better vault selection decisions? This article—the first in our series on DeFi vault security and risk management—explores these questions and lays the groundwork for a more sophisticated approach to DeFi investment.

Beyond "Number Go Up": Defining Risk in DeFi

Risk in traditional finance is often simplistically defined as the possibility of losing money. But in DeFi, risk takes multiple forms:

- Protocol risk: The possibility of smart contract vulnerabilities or exploits

- Market risk: Exposure to the volatility of underlying assets

- Liquidity risk: The ability to enter and exit positions without significant slippage

- Counterparty risk: Dependency on other protocols or services

- Regulatory risk: Potential impact of changing legal frameworks

For this article, we'll focus primarily on market risk—specifically, how to measure, understand, and manage the volatility inherent in crypto assets.

The Fundamentals: Volatility, Returns, and Risk-Adjusted Performance

Volatility: Measuring Uncertainty

Volatility is the most fundamental measure of risk in financial markets. It quantifies how much an asset's price fluctuates over time, typically expressed as the standard deviation of returns over a specific period.

Let's examine the historical volatility of BTC and ETH*:

*Throughout the document,the we use daily closing data from 1 Jan 2018 until 31 Mar 2025 for our calculations.

These figures reveal something critical: crypto assets experience 4-5 times the volatility of traditional equity markets. This extreme volatility has profound implications for portfolio construction and risk management.

Expected Returns: Past Performance vs. Future Expectations

While historical returns are easily calculated, expected future returns are much harder to estimate. Looking at BTC and ETH's average annual returns:

These extraordinary returns explain crypto's appeal. However, these arithmetic means can be deeply misleading for long-term investors—a critical point we'll explore shortly.

The Arithmetic vs. Geometric Returns Paradox

Here's where most DeFi investors go wrong: they focus on arithmetic mean returns, which significantly overstate expected performance for volatile assets over time.

Consider this simplified example:

An asset increases 100% in year one and decreases 50% in year two.

- Arithmetic mean return: (100% - 50%) ÷ 2 = 25% per year

- Actual final value: $100 → $200 → $100

- Geometric mean return: (($100 ÷ $100)^(1/2)) - 1 = 0%

The arithmetic mean suggests 25% annual growth, but in reality, you ended up exactly where you started (given you traded for free and didn’t pay any fees)! For volatile assets like cryptocurrencies, this discrepancy becomes enormous. The relationship between arithmetic and geometric returns can be approximated as:

Geometric Mean ≈ Arithmetic Mean - (Variance ÷ 2)

Applying this to our crypto assets, we compile the following comparative table:

This massive difference between arithmetic and geometric means explains why naïve extrapolations of crypto returns frequently lead to disappointment.

Statistical Significance: How Much Data Is Enough?

Perhaps the most sobering reality in crypto investment is that we simply don't have enough historical data to make statistically confident assertions about long-term performance.

When we perform a Student's t-test to determine how many years of data would be needed to statistically "prove" that ETH has a positive expected return (with 95% confidence), the answer is approximately ~14 years, far more than Ethereum’s 8-year existence. BTC, in comparison, requires around 8 years of data, so we can be “statistically” sure that its risk-adjusted return is positive.

Portfolio Construction: Beyond Single Assets

Given the extreme volatility and statistical uncertainty of individual crypto assets, strategic portfolio construction becomes essential. Our analysis in the DeFi Portfolio Vault divides assets into two primary categories:

Safe Yield: Lending protocols and yield-bearing tokensVolatile Assets: Primarily ETH and BTC (re)staking proxies

Using these categories, we can construct three portfolio approaches:

- Maximum Sharpe Ratio Portfolio: 100% Safe Yield, 0% Volatile Assets

- Optimizes risk-adjusted returns

- Lowest volatility approach

- Appropriate for risk-averse investors

- Risk Parity Portfolio: 92.5% Safe Yield, 7.5% Volatile Assets

- Equalizes risk contribution across asset classes

- Moderate volatility

- Balances growth potential with stability

- Maximum Geometric Mean Portfolio: 75% Safe Yield, 25% Volatile Assets

- Maximizes expected long-term growth rate

- Higher volatility

- Suitable for investors with longer time horizons

Time Horizon and Risk Capacity

The appropriate portfolio approach depends significantly on your time horizon:

Why? Because portfolio returns become less erratic over longer time horizons. This demonstrates a fundamental principle: the longer your investment horizon, the more capacity you have to bear short-term volatility in pursuit of higher geometric returns.

Systematic vs. Discretionary Approaches

One final insight emerges from our analysis: systematic, rules-based approaches consistently outperform discretionary "token picking" strategies over the long run.

Why? For several reasons:

- Systematic approaches eliminate emotional biases

- Most altcoins underperform BTC and ETH over extended periods

- High correlation between cryptocurrencies limits diversification benefits

- The statistical challenge of identifying outperformers is enormous

Research in traditional markets shows that 80-90% of active managers underperform their benchmarks over 10+ year periods. In crypto, with its higher volatility, shorter history, and market inefficiencies, the odds may be somewhat better, but the fundamental challenge remains.

Applying These Concepts to Vault Selection

When evaluating DeFi vaults, consider the following risk management aspects:

- Asset allocation: Does the vault have a clear, theoretically sound allocation strategy?

- Rebalancing mechanism: How and when does the vault adjust positions?

- Concentration limits: Are there caps on exposure to individual protocols?

- Execution safeguards: How does the vault protect against slippage and manipulation?

- Transparency: Is the risk management framework clearly documented?

Levva's DeFi Portfolio Vault implements these principles through:

- Strategic asset allocation between Safe Yield and Volatile Assets

- Threshold-based rebalancing when weights deviate by ±2.5%

- Concentration limits reviewed monthly (e.g., 20% maximum for Aave markets)

- Slippage controls and redundant price verification

- Transparent documentation of all risk parameters

Conclusion: The Science of Risk Management

DeFi investing doesn't have to be gambling. By understanding fundamental concepts like volatility, geometric returns, and portfolio construction, you can make more informed decisions about vault selection based on your specific time horizon and risk tolerance.

In our next article, we'll explore portfolio theory for DeFi in greater depth, examining why systematic allocation approaches beat token picking and how to implement these insights in your own DeFi strategy.