Levva's Strategic Evolution

The last months have been about building, experimenting, and seeing what works. Some things worked better than others, and that’s exactly why we’re making adjustments now.

This isn’t just another roadmap drop. This is where Levva stands today, the changes we’re making behind the scenes, and why these changes position us for long-term growth. The market is maturing, and so are we.

The next cycle will reward protocols that combine simplicity, real utility, and sustainable economics. That’s what Levva 2.0 is built for: AI-powered, fully automated DeFi portfolio management, accessible to anyone.

We're moving away from temporary liquidity incentives and shifting fully towards a scalable, product-driven model. Every decision here is designed to strengthen product fundamentals, align incentives, and set the stage for organic growth as we scale Levva into the next phase.

The Current State:

Let's start with transparency, a core value that has guided Levva from day one. Our community deserves clarity about where we stand and where we're heading.

The Liquidity Challenge

Over the past months, we've built up protocol liquidity through strategic partnerships. While these arrangements have served their purpose in bootstrapping our ecosystem, they've come at a significant cost. The current model, where we compensate liquidity providers at rates that exceed organic yield, has created pressure on our token economics.

The high cost of maintaining liquidity through these arrangements diverts resources from product development and community growth, resources that are better invested in building the future of DeFi portfolio management. This experiment, in incentivised liquidity, ends now.

Token Supply Dynamics

Following the $OPEN to $LVVA migration, our token supply structure has evolved significantly. The migration successfully unified our community under a single token, but it also concentrated much of our available supply in active circulation. This presents both a challenge and an opportunity. Our goal here is to remove liquidity providers as the primary source of sell pressure.

The Path Forward: Levva 2.0

So with these lessons learned, now it’s time to look ahead. Levva 2.0 represents our evolution from a leveraged yield farming protocol to a comprehensive AI-enhanced DeFi portfolio management platform.

AI-Powered Portfolio Intelligence

At the heart of Levva 2.0 is our AI Co-Pilot, designed to democratize sophisticated DeFi strategies. This isn't just another yield aggregator; it's an intelligent system that:

- Personalizes strategies based on individual risk profiles and investment goals

- Continuously optimizes portfolio allocations across protocols and chains

- Automates complex decisions that traditionally require deep DeFi expertise

- Manages risk proactively through real-time market analysis

Smart Vaults: Simplicity Meets Sophistication

Levva Vaults offer new vault strategies that cater to every investor profile:

Each vault employs our advanced routing and protocol adapter technology, finding optimal routes across multiple DEXs and protocols to maximize returns while controlling costs and slippage.

Strategic Realignment: From Costs to Growth

Winding Down Unsustainable Practices

We're making the difficult but necessary decision to significantly reduce our liquidity provider arrangements. This isn't about abandoning our partners, it's about building a sustainable foundation for long-term success. The resources previously allocated to these arrangements will be redirected toward:

- Product Development: Accelerating Levva 2.0 features and integrations.

- Marketing and Community Growth: Expanding our reach and user base.

- Strategic Partnerships: Building relationships that create mutual value.

- Incentives: Rewarding Levva 2.0 DeFi portfolio Vault stakers.

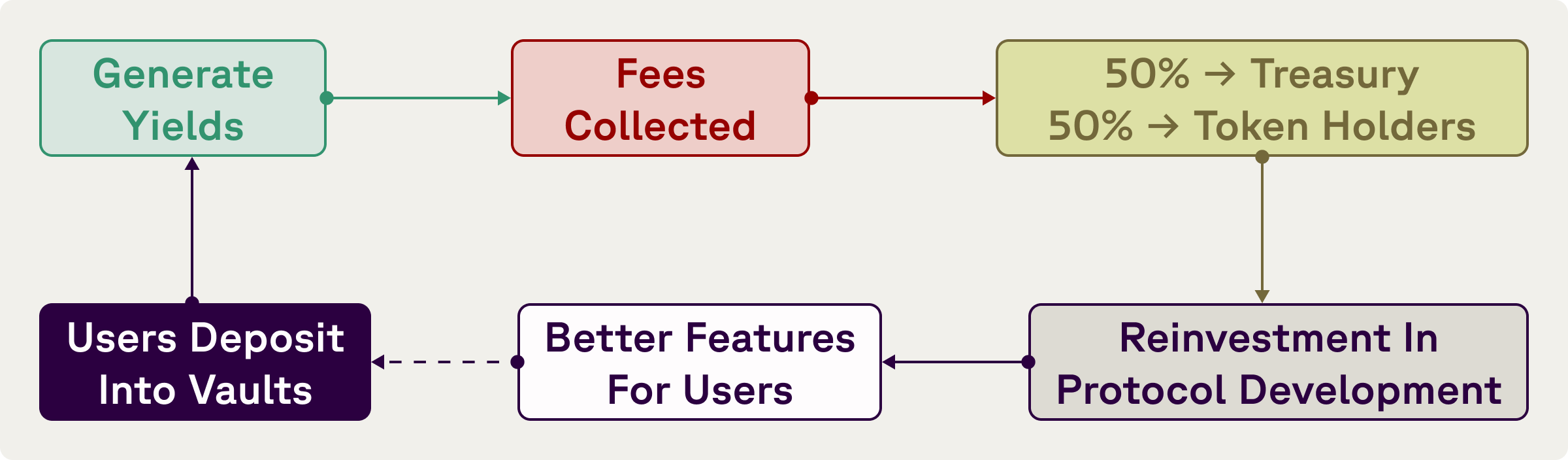

Revenue Generation and Value Accrual

Learning from successful DeFi protocols, we're implementing a clear, sustainable fee structure for assets held in Levva Vaults:

- Management Fee: A modest 1% annual fee on assets under management.

- Performance Fee: 10% of profits when portfolios exceed their high-water mark

- Fee Distribution: 50% to the protocol treasury, supporting ongoing development and operations, and 50% to liquidity referrals.

This model aligns our success with yours - we only succeed when you succeed. We envision a “fund of funds” where investors can build long-term wealth with Levva.

Governance: Your Voice, Our Direction

True decentralization means giving power to the community. We're launching our governance framework with Snapshot, starting with straightforward proposals to familiarize everyone with the process:

Initial Governance Proposals

- Ecosystem Expansion: Vote on which blockchain ecosystems to prioritize for Levva 2.0 deployment.

- Points Season Allocation: Determine how to distribute rewards in our upcoming liquidity bootstrapping campaign.

As we mature, governance will expand to cover:

- Tokenomics adjustments

- Fee structure modifications

- Strategic partnerships

- Treasury management

Learning from the Best: Next-Generation Tokenomics

The DeFi space has evolved beyond simple farming rewards. Projects like Curve pioneered vote-escrowed (ve) tokenomics, creating sustainable value through:

- Token Locking: Aligning long-term incentives

- Voting Power: Directing protocol resources and emissions

- Revenue Sharing: Distributing fees to committed stakeholders

- Bribing Mechanisms: Creating efficient markets for influence

We're studying these models carefully, along with innovations from our close competitors. Our future tokenomics updates will incorporate the best of these approaches while maintaining simplicity and accessibility.

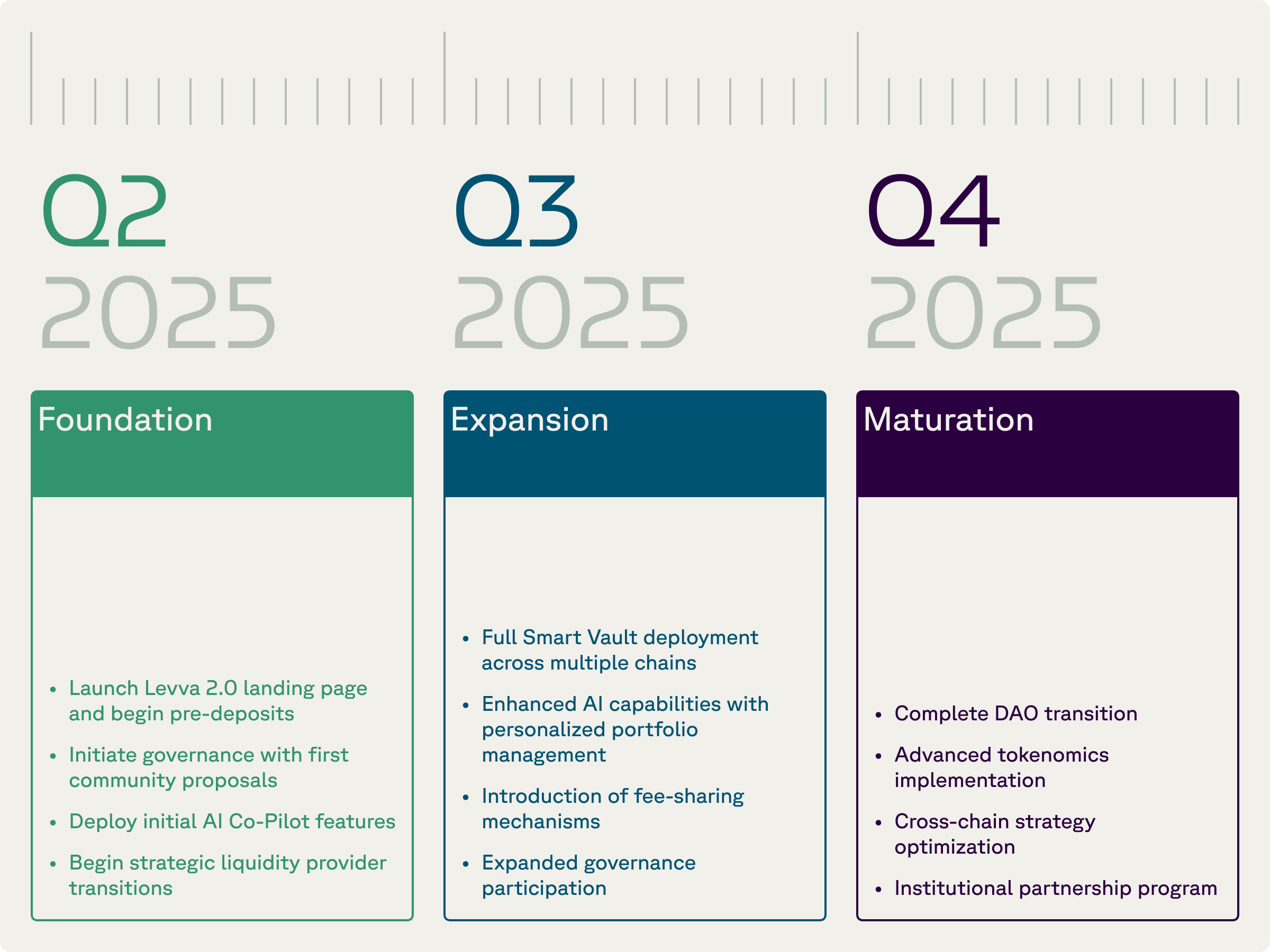

The Road Ahead: Key Milestones

Addressing Community Concerns

We understand that change can be unsettling, especially in DeFi, where trust is paramount. Let us address your concerns directly:

"How will Levva fund operations?" Through our sustainable fee model and strategic token emissions. By reducing wasteful spending on unsustainable liquidity arrangements, we can focus resources on building value.

"What about existing LP deals?" We're working closely with our partners to ensure a smooth transition. Some arrangements will continue at sustainable levels, while others will be wound down responsibly.

"Is this just another pivot?" No. This is an evolution. We're building on our existing infrastructure and expertise, not abandoning it. Levva 2.0 incorporates everything we've learned while expanding our capabilities.

Building Together

The challenges we face are opportunities in disguise. By confronting them transparently and evolving strategically, we're positioning Levva for long-term success in the rapidly maturing DeFi ecosystem.

This isn't just about surviving, it's about thriving. It's about building a protocol that serves real user needs with sustainable economics. It's about creating value that flows back to token holders through genuine utility, not unsustainable emissions.

We're excited about the future we're building together. The transition may require patience and understanding, but the destination, a truly decentralized, AI-enhanced portfolio management platform, will be worth the journey.

Join the Evolution

The success of Levva 2.0 depends on our community. Here's how you can participate:

- Engage in Governance: Your voice matters. Participate in our upcoming proposals.

- Test Early Features: Be among the first to experience Levva 2.0.

- Spread the Word: Help us build a movement around sustainable DeFi.

- Provide Feedback: Your insights shape our development priorities.

Together, we're not just building another DeFi protocol. We're creating the future of decentralized portfolio management, one that's accessible, intelligent, and sustainable.

The best is yet to come.

Levva 2.0 is coming. Be first in line.

Join the waitlist now and get 500 $LVVA + 1,000 Points when we launch. Connect your wallet & secure a rank to unlock.

Stay connected with Levva:

- Website: levva.fi

- Twitter: @levva_fi

- Discord: Join our community

- Telegram: @levva_fi