Risk Management in Action: Rebalancing and Concentration Limits in DeFi Portfolios

In our previous articles, we explored the fundamentals of risk in DeFi and examined how portfolio theory can be applied to optimize returns while controlling volatility. We introduced three portfolio strategies—Maximum Sharpe Ratio, Risk Parity, and Maximum Geometric Mean—each calibrated to different risk tolerances and time horizons.

But theory alone doesn't protect capital. Even the most perfectly constructed portfolio will drift from its target allocations as market prices fluctuate. Without active management, a carefully balanced portfolio can gradually transform into something entirely different from what was intended.

This article—the third in our series on DeFi risk management—explores how Levva implements rebalancing strategies and concentration limits to maintain optimal portfolio characteristics through market cycles.

Rebalancing: The Hidden Driver of Portfolio Performance

Rebalancing is perhaps the most underappreciated aspect of portfolio management. It's the systematic process of realigning portfolio weights to their target allocations, and it serves three critical functions:

- Risk Control: Prevents overexposure to any single asset or protocol

- Mean Reversion Capture: Systematically sells assets after they appreciate and buys them after they decline

- Volatility Harvesting: Extracts value from price oscillations even when assets trade sideways

The Rebalancing Dilemma: Time vs. Threshold

There are two primary approaches to rebalancing:

Time-based rebalancing: Adjusting to target weights at fixed intervals (e.g., monthly, quarterly). Threshold-based rebalancing: Rebalancing only when weights deviate from targets by a specified amount

Each approach has distinct advantages and limitations:

The research on optimal rebalancing strategies is extensive, but the consensus points to threshold-based approaches as generally superior for volatile assets like cryptocurrencies. A seminal study by Harjoto and Jones (2006) found that threshold-based rebalancing delivered higher risk-adjusted returns than time-based methods across various asset classes, with the advantage magnified in more volatile markets.

For crypto portfolios specifically, research by Borri (2019) demonstrated that threshold-based rebalancing with bands of ±5% outperformed both time-based approaches and strategies with narrower or wider thresholds.

Levva's Approach: Adaptive Threshold Rebalancing

Levva has implemented a sophisticated threshold-based rebalancing system optimized for DeFi market conditions:

- Asymmetric Thresholds: Different asset classes have customized rebalancing bands:

- Volatile Assets (ETH, BTC, XAUT): ±5%

- Yield-Bearing Assets (Aave, Morpho, Ethena, Levva): ±10%

- Cost-Aware Execution: Rebalancing decisions incorporate transaction costs, slippage, market impact, and gas fees - total costs.

- Volatility-Adjusted Thresholds: During periods of extreme market volatility, thresholds are dynamically widened to prevent excessive trading.

This approach strikes an optimal balance between maintaining target allocations and minimizing unnecessary transaction costs. Our backtests show that adaptive threshold rebalancing improves the Sharpe ratio by approximately ~0.10 - 0.15 compared to quarterly time-based rebalancing for comparable DeFi portfolios.

Concentration Risk: The Silent Portfolio Killer

While market volatility captures most of the attention in risk discussions, concentration risk—overexposure to a single protocol, token, or yield source—can be equally destructive to portfolio performance.

In traditional finance, concentration risk typically refers to sector or geographic overexposure. In DeFi, concentration risk takes additional forms:

- Protocol Concentration: Excessive exposure to a single smart contract system

- Yield Source Concentration: Overreliance on a single mechanism for generating returns

- Bridge/Layer Concentration: Overexposure to specific blockchain bridges or L2 solutions

The Challenge of Protocol Diversification

Diversification across protocols is essential for mitigating smart contract risk, but it introduces a complex optimization problem: how to balance protocol quality against diversification benefits.

Levva resolves this challenge through a tiered protocol approach:

Tier 1 (Core Exposure): Battle-tested protocols with exceptional track records

- Lending: Aave, Morpho

- Yield Generation: Ethena (sUSDe)

- ETH Exposure: Lido (wstETH)

- BTC Exposure: EtherFi (eBTC)

Tier 2 (Satellite Exposure): Quality protocols with strong security profiles

- Additional yield sources

- Alternative LRTs/LSTs

Each tier has distinct concentration limits, with no single protocol exceeding 20% of the total portfolio value. This approach ensures meaningful diversification while maintaining exposure to the highest-quality protocols.

Equal Weight vs. Risk-Weighted Allocations

Within each asset category, Levva implements an equal-weight approach to protocol exposure. This decision is driven by the statistical challenges outlined in our previous article: the difficulty of confidently identifying superior protocols given limited historical data and high correlation between similar yield sources.

For example, rather than attempting to predict which lending protocol will outperform, Levva allocates equally between Aave and Morpho within the lending category. This approach acknowledges the limitations of return prediction while still capturing the diversification benefits.

Market Impact: Navigating DeFi Liquidity Challenges

Executing portfolio adjustments in DeFi requires navigating fragmented liquidity, varying exchange mechanisms, and protocol-specific constraints. Levva's infrastructure addresses these challenges through specialized adapters for each protocol and asset type.

Protocol-Specific Entry and Exit Mechanisms

Each supported protocol requires distinct approaches to efficient capital deployment and withdrawal:

Lending Protocols (Aave, Morpho)

- Entry: Direct deposit of stablecoins.

- Exit: Withdrawal subject to utilization constraints.

- Contingency: Secondary market liquidity when utilization exceeds thresholds.

Liquid Staking (Lido, EtherFi)

- Entry: Purchase ETH/BTC → Stake through the protocol

- Exit: Two methods:

- Direct unstaking (subject to the protocols' unstaking periods)

- Secondary market liquidation through DEXs

Yield-Bearing Stablecoins (sUSDe)

- Entry: Purchase USDe → Stake for sUSDe

- Exit: Unstake sUSDe → Sell USDe

We implement so-called adapters to allow for the integration with supported protocols

The Solver Architecture: Optimizing Trade Execution

To minimize market impact across this diverse ecosystem, Levva has developed a "solver" architecture that determines optimal trade execution strategies.

The core of this system is an exchange graph representing all potential trade paths between supported assets. Each edge in this graph represents a liquidity pool with associated costs (fees, slippage, price impact). Using Dijkstra's algorithm—a proven method for finding the shortest path in weighted graphs—the solver identifies the most cost-effective route for any given trade. For more details on the solver architecture, read our technical deep dive.

Circuit Breakers and Slippage Control: Guardrails for Market Stress

Even the most sophisticated execution strategies require safeguards against extreme market conditions. Levva implements multiple layers of protection:

1. Maximum Slippage Parameters

Each transaction includes configurable slippage limits that prevent execution at unfavorable prices. These limits are calibrated to each asset's typical liquidity profile:

- Stablecoins: 0.05% maximum slippage

- ETH/BTC: 0.1% maximum slippage

- LRTs/LSTs: 0.1% maximum slippage

2. Volume-Based Circuit Breakers

Transactions exceeding certain size thresholds relative to available liquidity are automatically split into smaller tranches executed over time. This prevents large orders from moving the market against the portfolio.

3. Volatility-Triggered Pauses

During periods of extreme market volatility (defined as 2.5+ standard deviation price movements within 24 hours), non-essential rebalancing operations are automatically suspended until conditions normalize.

4. Oracle Redundancy

All price feeds used for trade execution decisions incorporate multiple sources with outlier rejection algorithms, ensuring resilience against oracle manipulation attacks.

These safeguards work in concert to protect portfolio value during market stress while still enabling essential risk management operations.

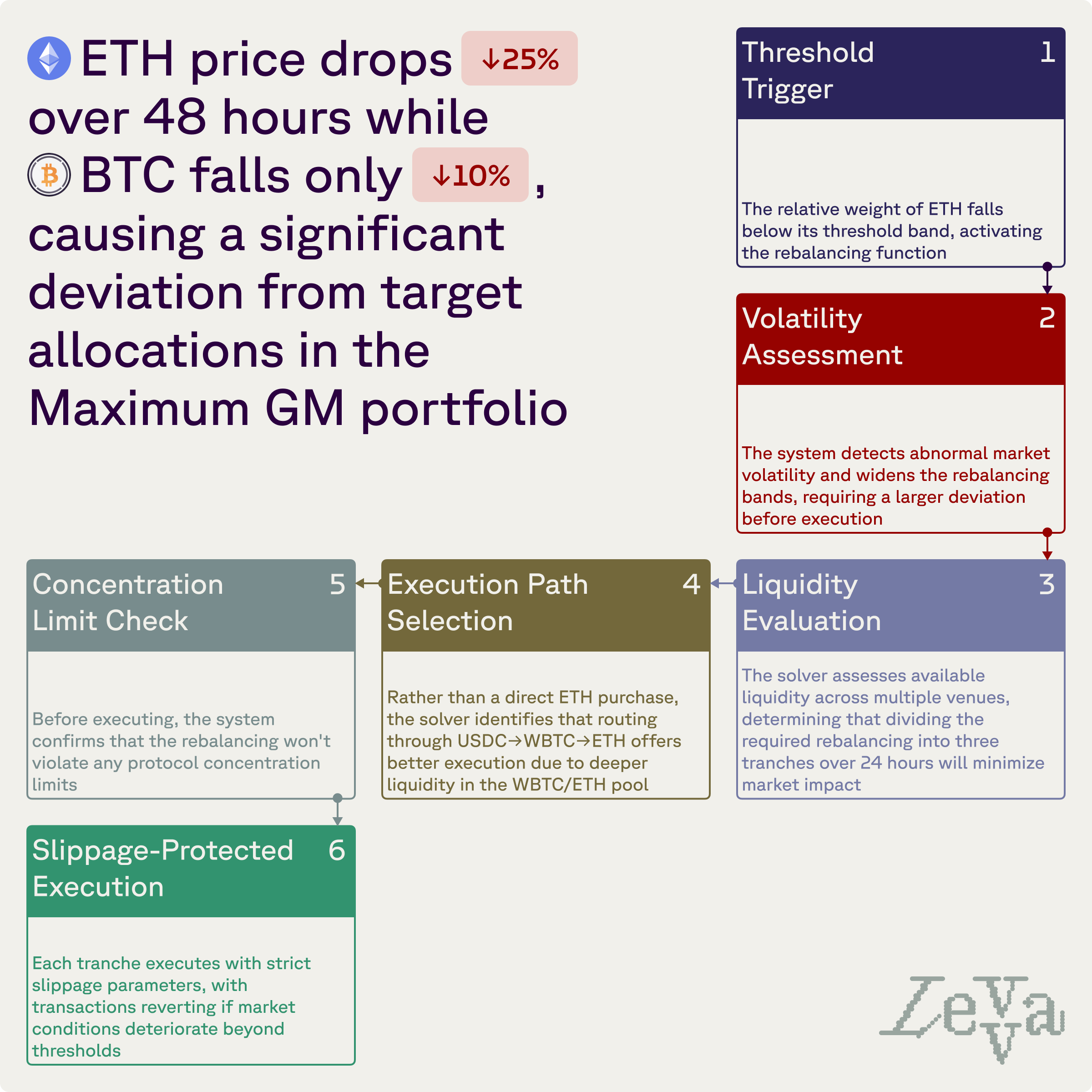

Case Study: Risk Management During Market Stress

To illustrate these principles in action, let's examine how Levva's risk management framework would respond to a hypothetical market scenario:

This coordinated response demonstrates how multiple risk management mechanisms work together to maintain portfolio integrity while protecting against adverse execution.

Conclusion: The Symphony of Risk Management

Effective risk management in DeFi isn't about implementing a single protective measure—it's about orchestrating multiple complementary systems that respond dynamically to market conditions.

Levva's approach combines:

- Optimal rebalancing strategies calibrated to different asset classes

- Concentration limits that balance quality and diversification

- Advanced trade execution algorithms that minimize market impact

- Multi-layered safeguards against extreme market conditions

Together, these mechanisms transform theoretical portfolio construction into practical, resilient investment strategies capable of navigating DeFi's volatility.

In our next article, we'll explore how to measure and evaluate DeFi portfolio performance, moving beyond simplistic APY comparisons to more sophisticated risk-adjusted metrics that reveal true investment quality.