Pendle: new way to farm in DeFi

By now, almost everyone who’s heard about DeFi has probably heard about the Pendle Protocol. Let’s dive into the specifics, and understand why Pendle came to be the 6th largest DeFi protocol with more than $6B in TVL at the peak of an LRT frenzy this summer - all of this in the course of just 6 months since the year start.

Pendle is a permissionless yield-trading protocol built to trade yield. Within Pendle, yield-bearing assets are split into two components: the principal tokens (PT) and the yield tokens (YT). PT tokens allow users to earn a fixed yield until maturity. YT tokens allow users to speculate on yield with leverage and earn variable APY.

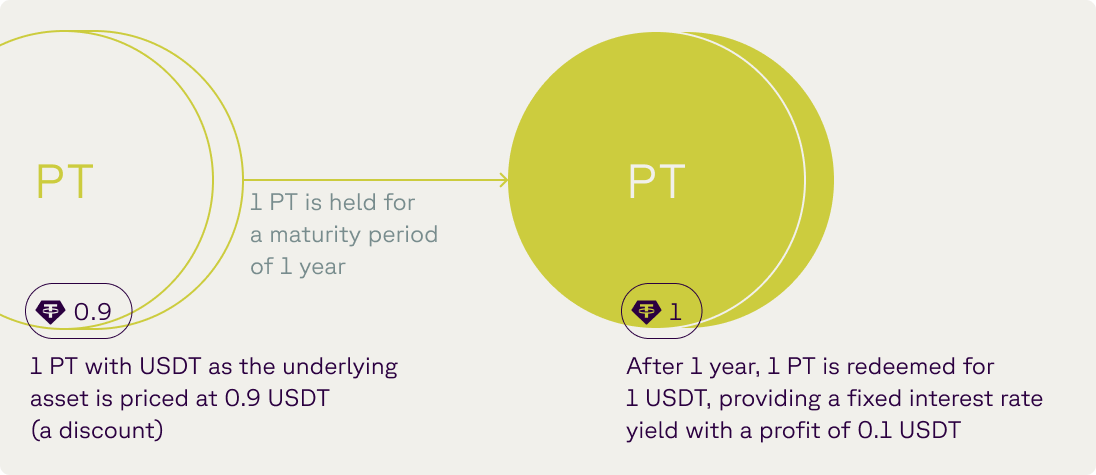

Principal Tokens (PT) PT tokens entitle holders to the principal of the underlying yield-bearing asset and are redeemable 1 to 1 with the principal at maturity. PT tokens are freely tradable up until maturity.

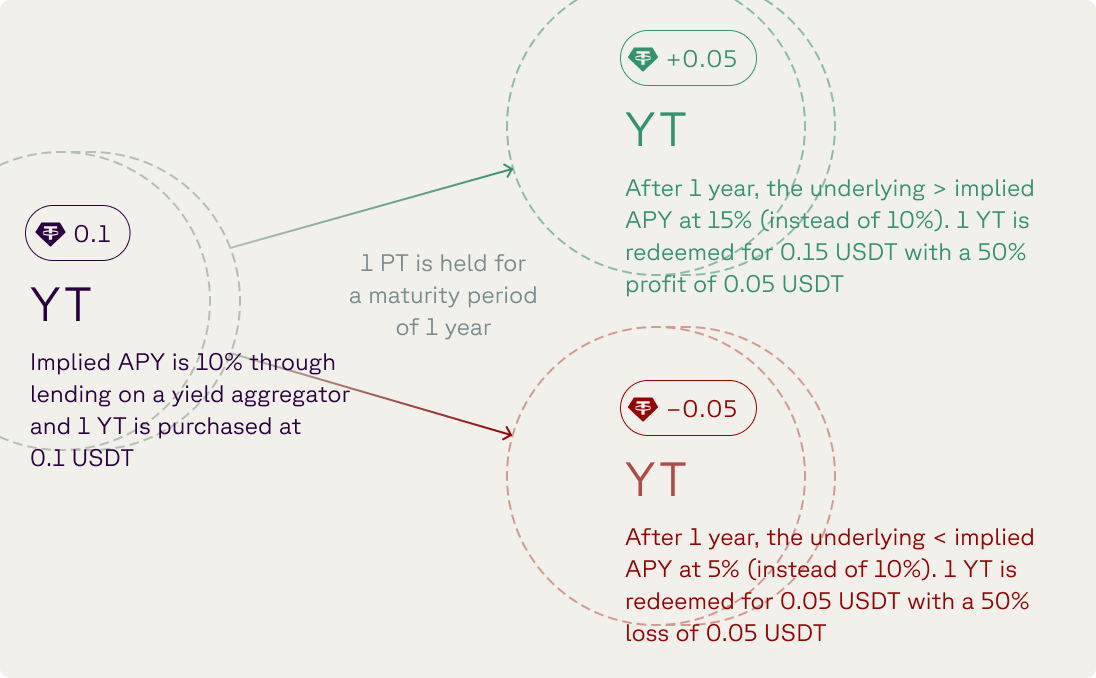

Yield Tokens (YT): Buying and holding yield tokens gives holders the right to receive the accrued rewards from the associated underlying asset after a specified maturity period.

Yield strategies and points farming

Pendle’s PT and YT tokens allow the DeFi crowd to utilize yield trading strategies. Here they are:

- Buying PT tokens to lock in a fixed yield.

- Buying YT tokens to get leveraged yield exposure.

- Buying YT tokens to get leveraged Points farming exposure.

Points farming: buy YT tokens to farm points of corresponding restaking and liquid restaking protocols. Check out the current pools https://app.pendle.finance/trade/pointsPoints farming frenzy has been THE ultimate trade of the current #LRTfi summer. Points farming helped Pendle to become a DeFi unicorn and led to its rapid TVL growth. Points farming is also responsible for driving the yield on PT tokens higher:

- Pendle’s PT/YT price relationship is governed by one simple equation: PT price + YT price = Underlying price. So, the higher the YT token price; the lower the PT token price. Now let's think, what happens to PT token prices when all of the DeFi crowd goes in to buy YT to farm points?

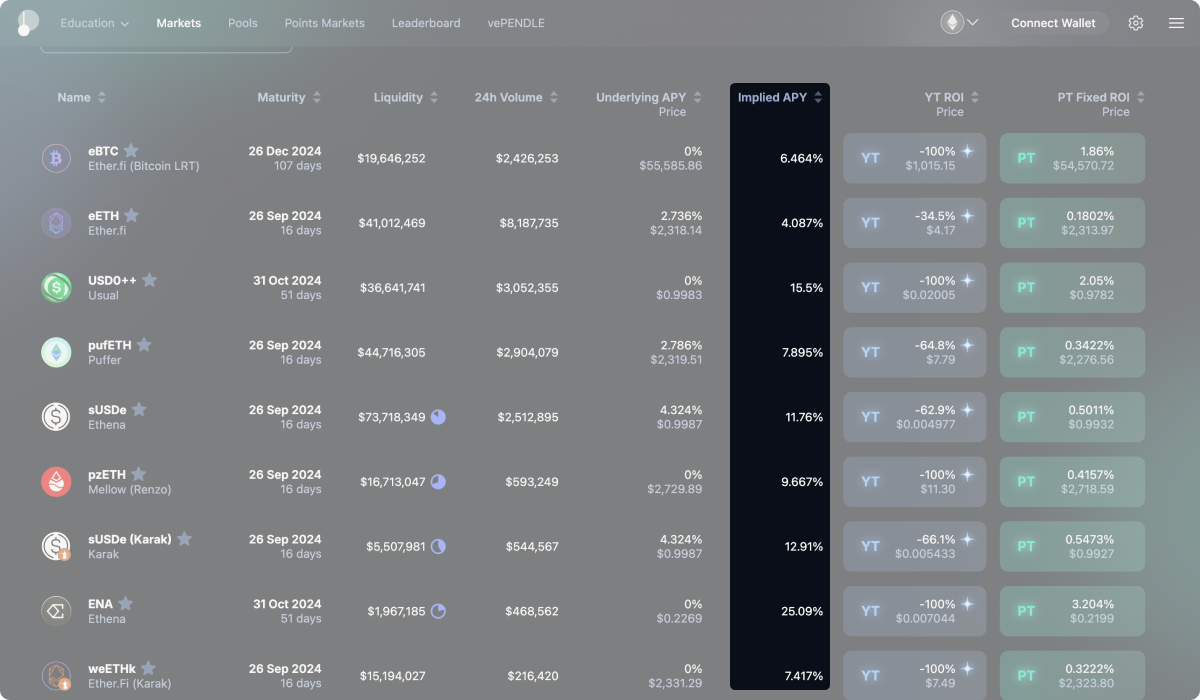

You guessed it right: PT token price will get depressed! Depressed prices = high implied yields until maturity - something that we do indeed observe directly on the Pendle app:

Levva Vaults: Utilize Pendle’s yield farming strategy

The bottom line: Pendle protocol allows people to earn high yields to maturity on various yield-bearing assets. This makes Pendle protocol a perfect candidate for a Vault investment in Levva. The yield exposure can be additionally leveraged, given that Levva vaults find a market where the interest to be paid is lower than the yield to be earned on Pendle. Alternatively, Levva Vaults may choose to get exposure to Pendle’s YT tokens to farm leveraged points of various liquid staking tokens. In both cases, the associated risks and allocation weights have to be gauged carefully.

Some of the risks associated with the Pendle protocol are common to all of the DeFi space: smart-contract risk, pool liquidity risk, and LRT exposure risk. These are dealt carefully within Levva’s comprehensive risk management and allocation framework to yield proper Pendle allocation weights and identify reallocation rules for Vaults that chose to connect to the Pendle protocol.