How Smart Portfolio Management Saved Investors From the October Crash

October 10, 2025, will be remembered as one of crypto's darkest days. In a matter of hours, $19 billion in leveraged positions were liquidated - the largest wipeout in crypto history. Bitcoin plummeted from $122,000 to below $110,000. Ethereum crashed by over 20%. Some altcoins lost 90% of their value. Over 1.6 million traders saw their accounts evaporate.

For context, this liquidation event was 20 times larger than the March 2020 COVID crash and dwarfed even the FTX collapse of 2022.

The trigger? President Trump's announcement of a 100% tariff on Chinese imports escalated the US-China trade war to unprecedented levels. But here's what most people missed: the warning signs were there, flashing red, nine days before the crash.

The 2010 Flash Crash: A Lesson Unlearned

This isn't crypto's first rodeo with catastrophic market events. Cast your mind back to May 6, 2010, when the U.S. stock market experienced its now-infamous "flash crash" - $1 trillion wiped out in minutes. Thanks to detailed research by Nanex, we learned that even back then, markets were dominated by machines and high-frequency trading algorithms processing 100,000 quotes per second.

Fast forward to today, and crypto is no different. Major prop trading firms like Jump Crypto, Jane Street, DRW (Cumberland), Tower Research Capital, Akuna Capital, Flow Traders, and Wintermute dominate crypto markets with information and access that retail traders can only dream about. The sharks are bigger, faster, and better equipped than ever.

The hard truth: these events will happen again. The market has matured. Institutional players hunt retail capital with systematic precision. But even in this environment, rational portfolio management can protect you.

The Warning Nobody Heeded

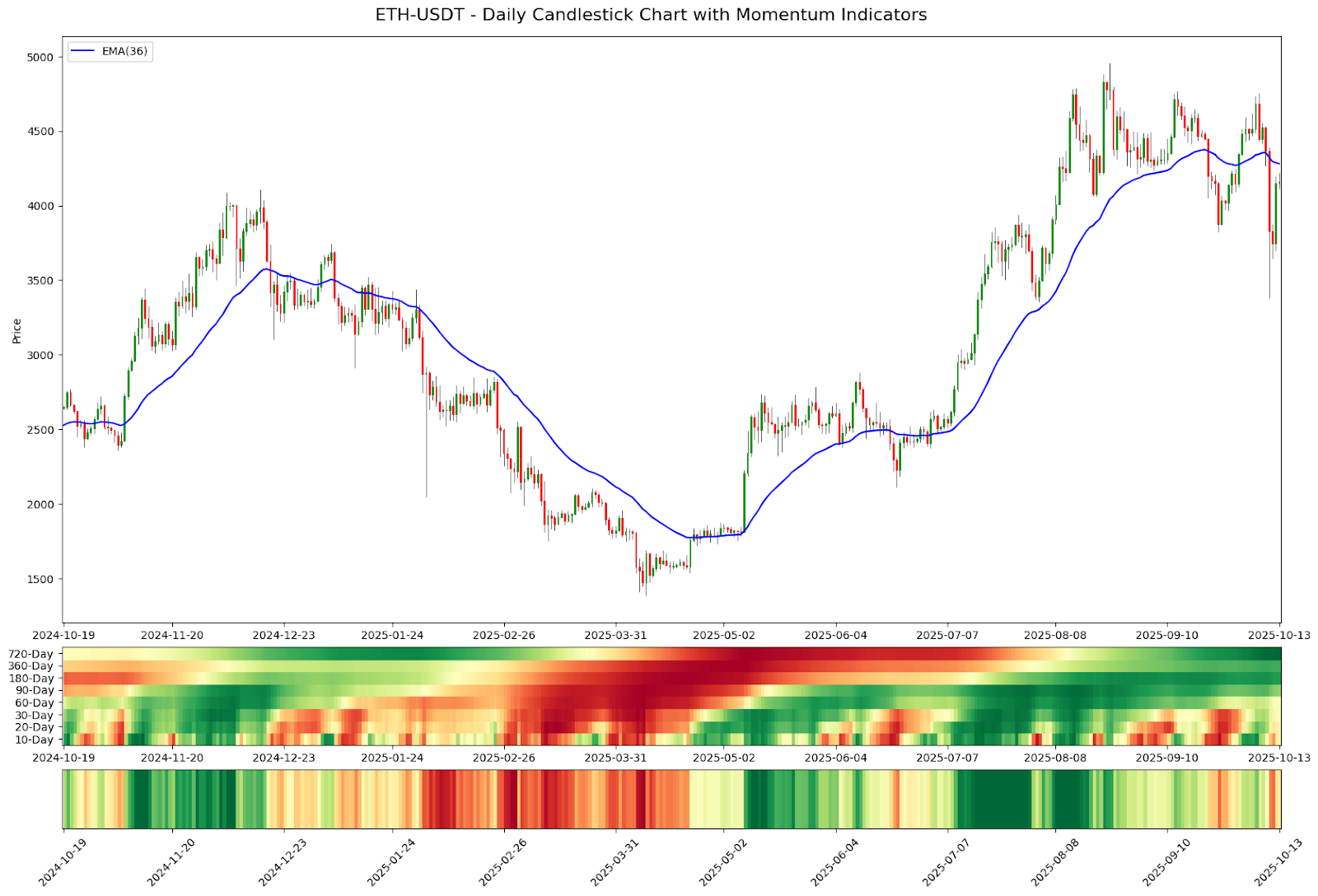

At Levva, we track market momentum using volatility-normalized indicators with 10 to 30-day lookback periods. These aren't crystal balls - they're systematic tools that measure when the market is trending versus when it's flashing danger signals.

Here's what our momentum indicator was showing in the days leading up to the crash:

September 27: Momentum peaked at a z-score of +2.02 (strong bullish signal)

October 1: Momentum turned decisively negative at -1.39 (exit signal)

October 1-9: Average z-score of -1.61 (sustained "strong exit" signal)

October 10: The crash happened

The indicator gave investors nine full days to de-risk their portfolios. Not a few hours. Not a few minutes. Nine days.

When momentum shows weakness, Levva's systematic approach is simple: we don't try to be heroes. We exit volatile positions and rotate to stablecoins. We NEVER short - we just step aside and let the storm pass.

By The Numbers: Protection vs. Destruction

Let's compare what happened to different types of investors during the October 10 crash:

The Levva Difference: Why This Approach Works

Levva's methodology isn't magic - it's professional-grade portfolio management, adapted for DeFi and made accessible to everyone.

- No Leverage, Ever

We don't use futures, we don't use perpetuals, we don't offer 10x or 100x positions. Leverage amplifies both gains and losses, and in volatile markets, it's a ticking time bomb. Levva vaults operate on spot only.

- Controlled Exposure to Volatile Assets

Even our most aggressive vault (Brave) caps volatile asset exposure at 25% under normal conditions. Compare this to the typical crypto investor who goes 100% into ETH or worse, 100% into the latest altcoin. Our vaults invest in blue-chip assets only: wstETH (Lido), eBTC (Etherfi), XAUT(Tether) - no moonshots, no shitcoins.

- Momentum-Based Market Timing

We track market momentum using exponential moving averages normalized by realized volatility. When momentum is strong (z-score > +1), we maintain exposure. When momentum weakens (z-score < -1), we reduce exposure systematically. It's not about predicting the future - it's about responding to what the market is telling us right now.

- Diversified Yield Generation

The 75% stablecoin allocation in Brave isn't sitting idle. It's deployed across battle-tested DeFi protocols:

- Aave v3: Market-leading lending protocol with billions in TVL

- Ethena's sUSDe: Delta-neutral synthetic dollar with funding rate yield

- Audited, Institutional-Grade InfrastructureOur smart contracts have been audited by QuantStamp. Our vault architecture builds on proven frameworks from Morpho and Euler. We don't reinvent the wheel - we use battle-tested components assembled professionally.

The "Aha" Moment: It's About Surviving, Not Gambling

Here's the insight that separates professionals from gamblers: in crypto, your first job is to survive. Not to 10x in a month. Not to become a millionaire overnight. To survive.

Think about it:

- If you lose 50%, you need a 100% gain to get back to even

- If you lose 90%, you need a 900% gain to recover

- If you get liquidated, you need infinite returns because you're starting from zero

Levva's Brave Vault, even without momentum timing, would have kept your portfolio within -4.3% of its high-water mark. With momentum timing, you'd barely feel the crash at -0.9%. Meanwhile, leveraged traders lost everything.

This is the power of systematic risk management. It's not sexy. It won't make you rich overnight. But it will keep you in the game when others are forced out.

Your Portfolio, Protected

The October crash taught us, once again, that crypto markets can turn savage in an instant. But it also proved something more important: rational, systematic portfolio management works.

While others were getting liquidated, Levva's approach would have protected capital. While others were panic-selling at the bottom, our momentum indicators were already planning the recovery. While others learned expensive lessons, Levva users could have slept soundly.

The choice is yours. You can keep gambling on leverage, hoping you'll time the market perfectly. Or you can build a portfolio that's designed to survive and thrive through whatever the market throws at you.

Check out Levva's vaults and see how professional portfolio management can transform your DeFi experience.