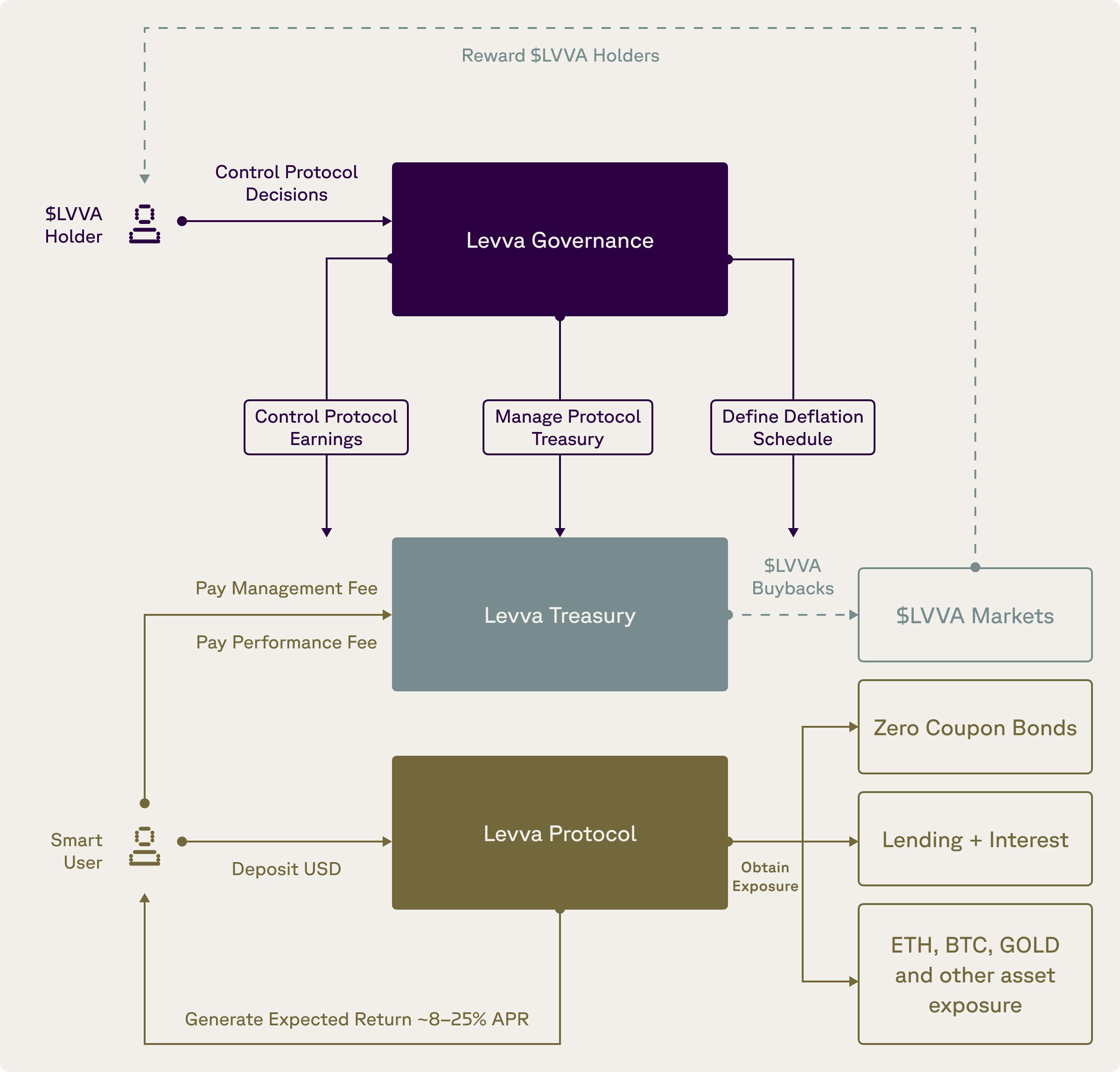

The $LVVA Flywheel: How Value Flows Back to Holders in Levva 2.0

With Levva 2.0, $LVVA is about to shift from passive token to protocol-native asset with real, compounding utility.

Here’s how it works and how value flows through the system.

What Is $LVVA?

$LVVA is the native token of Levva 2.0. It plays three key roles in the ecosystem:

- Governance: Token holders control the protocol treasury, fee structure, and roadmap.

- Value Capture: Protocol earnings are used to buy back $LVVA from the market.

- Deflationary Mechanics: Governance can choose to burn $LVVA, reduce emissions, or direct rewards back to stakers.

On top of that, $LVVA is already used for staking, and our veLVVA tokenomics will enable advanced utility like boosted vault rewards, governance voting, and emissions control.

The Levva 2.0 Flywheel

As Levva starts generating real protocol earnings, here’s how the token flywheel spins:

- Users deposit capital into Levva’s Smart Vaults

- Vaults generate yield through structured DeFi strategies

- A portion of that yield is collected as management and performance fees

- Fees flow into the Levva Treasury

- Treasury allocates capital to:

- Buy back $LVVA from the open market

- Fund operations, grants, and ecosystem incentives

- Enable future burns, decided via governance

All of this creates a complete value loop where protocol usage directly benefits $LVVA holders.

And we redirect 100% of revenues back to token holders and LPs.Yes, even Hyperliquid "only" redirects 97%, we go further.

Gradual Activation Post-Launch

This mechanism does not launch with the Beta phase. It will activate after the full Levva 2.0 release, rolling out gradually over the following weeks:

- Proposal voting (via Snapshot)

- Vault earnings collection

- Fee redistribution options (e.g., to stakers or vault participants)

- Management of the treasury by governance

- Initial buyback programs

Where Does Value Come From?

Levva is not promising magic APYs. We are building real, structured yield pipelines by aggregating top-tier DeFi strategies, including:

- Lending (Aave, Morpho, Euler, Ethena)

- Leveraged PT (Pendle) and LRT (Etherfi, Lido)

- Liquid staking and other yield-bearing assets

As vault TVL grows, so does treasury inflow and buyback power.

Why It Matters

- Buybacks mean real market support

- Governance lets holders control the treasury

- Deflation reduces the circulating supply

- veLVVA boosts rewards and incentives long-term

- Staking creates alignment between users and the protocol

This isn’t about hype. It’s about building a system where users and holders benefit together, transparently and sustainably.

Levva 2.0 is more than a DeFi app. It’s a framework for permissionless, intelligent, and capital-efficient on-chain asset management. As AI removes complexity for users, $LVVA captures the value of everything happening under the hood and routes it back to the community. The flywheel is about to start spinning. Make sure you're part of it.