Levva is Reshaping Liquidity Management in Web3 with its Innovative Universal Leverage Protocol

Although only in its infancy, Decentralized finance (DeFi) and its innovative applications and protocols have fundamentally changed the way we access digital assets, completely reshaping financial market dynamics. The industry has seen a boom in these types of decentralized applications (dApps), led by the growth of liquidity management and lending protocols that provide instantaneous, and leveraged, liquidity for market participants.

As the industry continues to mature these applications and protocols will need to tap into their inherent innovations and become more efficient to tailor to the needs of a more advanced investor base. As institutional capital starts to flow into DeFi, protocols are needed with advanced tools that are versatile, have customizable risk management capabilities, and can function across the many fragmented blockchains.

In this blog, we will dive into the different types of protocols and their investment strategies, examine how they are interconnected, and then look at some common obstacles they face. Levva will then be introduced, which is an innovative new liquidity management protocol that is a versatile and efficient solution for leveraging liquidity in the ever-evolving DeFi landscape.

Interconnected Yield Optimization Strategies Offer Higher Rewards and Risks for Advanced DeFi Users

Whilst it is difficult to pinpoint a specific start date, the DeFi industry grew in significance and was officially stress-tested during the DeFi summer of 2020/21. This period was spurred on by the advent of smart contracts and the growth of early dApps like Uniswap, Maker, and AAVE, all of which were released and experienced massive growth from 2018 onwards.

Following these developments, more sophisticated liquidity management protocols emerged. These new protocols have built on the foundational layers established by DEXs and borrowing and lending protocols, enabling advanced actions such as yield farming and leveraged margin trading.

Yield farming protocols were one of the major drivers of DeFi's explosive growth in 2020/21. They employ an investment strategy that maximizes returns by providing liquidity to DeFi protocols offering higher rates of return for their deposit. Although riskier, if timed for favorable market conditions, this strategy has proven to be a lucrative way to increase investors' cryptocurrency holdings. Some of the largest protocols that offer the most secure returns include PancakeSwap, SushiSwap, and Curve.

Yield farming strategies can be enhanced with the use of leverage. Leverage refers to the borrowing of capital to open an investment position, amplifying the potential gains or losses of a yield strategy. When applied effectively, leverage allows a user to control a larger position in an asset compared to utilizing their own capital, magnifying both gains and risks. This, of course, isn’t unique to DeFi, it is also used in traditional financial (TradFi) markets like stocks, bonds, commodities, and real estate.

An effective form of leverage is margin trading, which involves depositing collateral into a DeFi protocol to increase an investor's buying power. Margin trading allows users to borrow cryptocurrency at an interest rate that depends on the utilization rate of the DeFi protocol. This higher-risk investment strategy, another core method in traditional finance, offers the same promise of risk and reward when applied to DeFi. However, in DeFi protocols, it is executed in a much more accessible and seamless manner.

As we explore these different strategies, it is clear that they are all interconnected. Each DeFi investment strategies provide higher risk plays compared to simply holding cryptocurrencies. When used effectively, they have increased returns for investors, and each method is inextricably linked to the others, particularly for more advanced DeFi investors. Although profitable, the many disconnected blockchains, applications, and protocols have led to challenges that make investing in DeFi an intimidating task for newly onboarded users.

Liquidity Fragmentation and Adverse Market Conditions Continue to Fracture the Potential of Yield Optimization Strategies

At its peak in 2021 DeFi saw over $170B total value locked in their protocols, but pales in comparison to the estimated $100T+ in traditional capital markets. If the efficiencies of DeFi are to capture a portion of this, then it needs to prepare by overcoming challenges that make it easier for sophisticated investors to enter the market.

The first challenge is the fragmentation problem. The fragmentation problem arises from the existence of multiple, isolated blockchain networks that cannot communicate with each other. This results in liquidity being spread across various protocols and chains, rather than being readily accessible in a single marketplace. Each of these blockchain networks has unique consensus rules and design choices, which further exacerbate this issue by making interoperability and seamless communication difficult.

There are three main forms of liquidity fragmentation. The first is single-chain fragmentation, where liquidity is dispersed among different protocols on the same chain. The second is cross-chain fragmentation, where liquidity is divided across multiple blockchains. The third is protocol-level fragmentation, where isolated liquidity pools can’t cater to different borrowing scenarios across protocols. This last issue has created isolated pools like stETH/WETH, BTC/WETH, and USDC/WETH, which are all borrowed against WETH, but there is no single pool to deposit the WETH into.

Another challenge is the effect that volatile market activity has on yield strategies involving liquid staking tokens (LSTs) and liquid re-staking tokens (LRTs). The primary concern is price dislocations, also known as de-pegging, between LSTs and their underlying assets. De-pegging creates arbitrage opportunities across different markets. Although arbitrage helps mitigate price discrepancies during normal market conditions, it can be hindered during significant market events. This amplifies risks when prices diverge sharply or liquidity dries up. These issues also contribute to the liquidity risk for LSTs, which concentrates liquidity on a few sources, such as the stETH/ETH pool on Curve.

As DeFi continues to evolve, innovative protocols must harness tools that enhance liquidity management across the entire DeFi ecosystem. As more sophisticated investors start onboarding into DeFi, these challenges need to be addressed; otherwise, the unified potential of these profitable protocols could remain fractured.

Levva Automates Liquidity Management with their Universal Leverage Layer for Web3

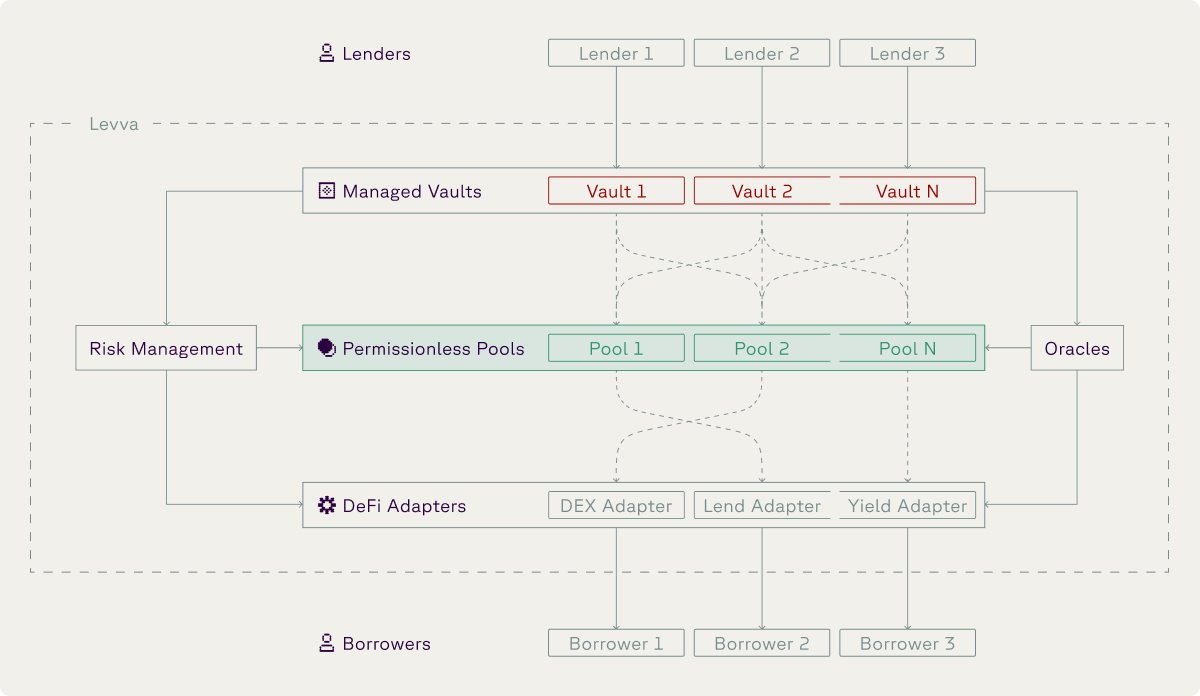

Levva is a permissionless lending protocol that offers universal yield and leverage in DeFi. It provides infrastructure for efficient on-chain liquidity management, connecting liquidity providers with borrowers. Levva addresses capital fragmentation and maximizes utilization across DeFi use cases and protocols, accelerating value accrual for lenders.

Levva caters to both sides of the liquidity management user base. For liquidity providers, also known as lenders, Levva offers yield-generating opportunities through professionally managed lending pools. For borrowers, Levva provides smart contract technology serving a range of borrowing use cases, such as collateralized borrowing, leveraged spot trading, and leveraged points/LRT/yield-bearing asset farming.

Lending an asset is the easiest way to interact with the Levva protocol. Levva alleviates the complexities with decision-making when lending liquidity, lowering barriers to entry and making liquidity provision seamless. Lenders can interact directly with lending pools if they know the exact use case they’re after. Alternatively, they can place their liquidity into special-purpose vaults designed to mimic professional money managers, who pick vault allocations, define vault strategies, and control vault parameters on behalf of the lenders. For a more detailed explanation of the lending capabilities for Levva users, please check Levva’s documentation.

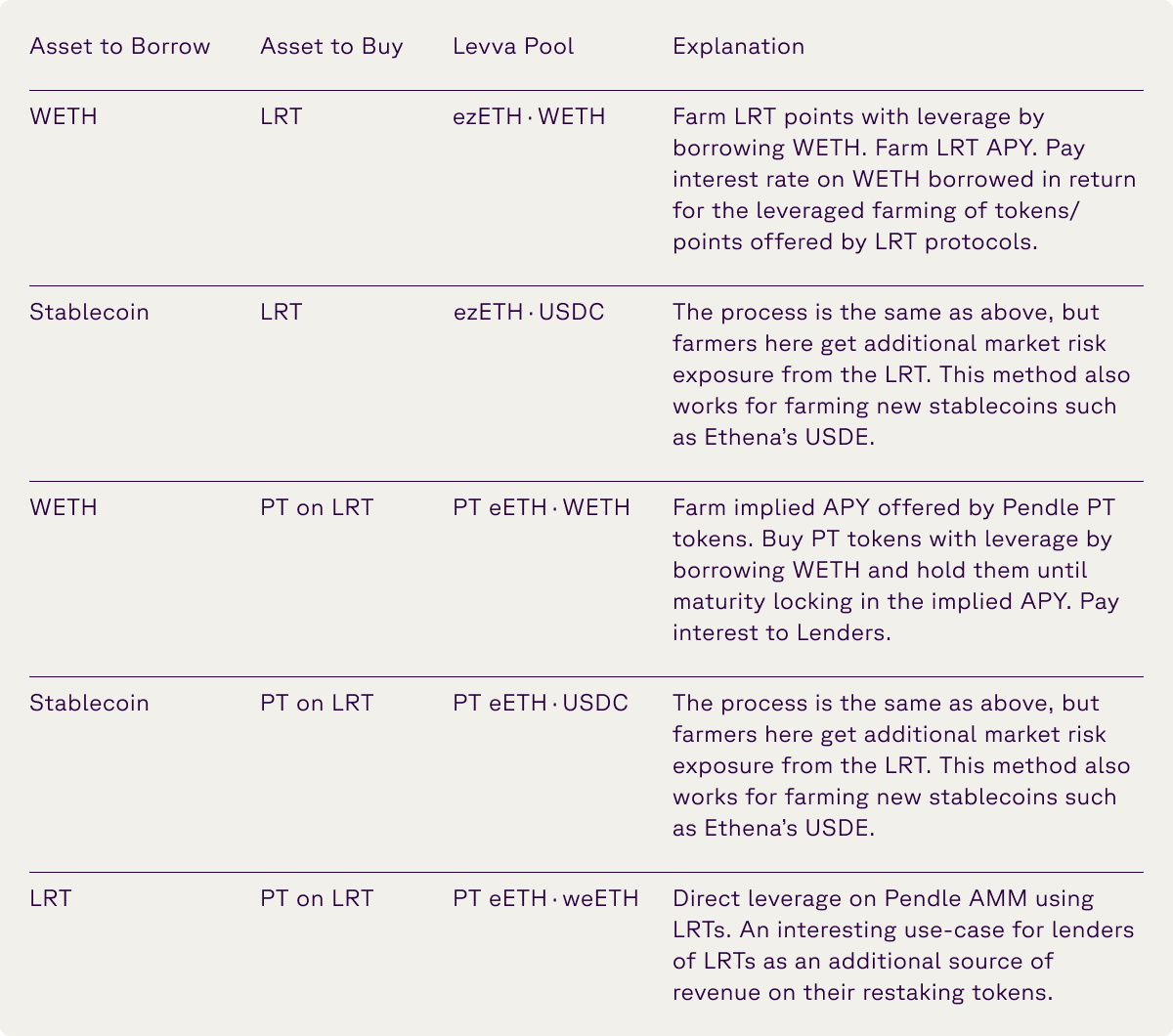

Borrowers can supply assets and take out collateralized loans from Levva pools. Different Levva pools support different assets and serve various borrower use cases. Levva pools manage borrower positions, automatically liquidate them when risk thresholds are breached, automatically accrue interest rates on borrowers, and redistribute accrued interest back to lenders. By keeping the risk parameters and controls at the pool level, Levva achieves unmatched flexibility in risk management. The creation of Levva pools is completely permissionless, allowing different protocols and service providers to build non-custodial applications on top of Levva pools that empower borrowers with various leveraged farming strategies. You can find some of the initial leveraged farm strategies in the table below.

Thanks to Levva's multi call functionality, vaults can call multiple smart contracts within the same blockchain transaction. This functionality allows users to combine leveraged borrowing in Levva's pools and interact with other DeFi protocols. This introduces the use of delta-neutral strategies, which earn users yields through funding fees on Perp DEXs and lending to Levva vaults, as well as cross-lending market neutral strategies, which consist of token positions on DEXs like Uniswap with borrow positions on Levva, either directly or against the underlying asset. For a more detailed explanation of the borrowing capabilities for Levva users, please check Levva’s documentation.

Levva's robust risk management features include the lowest liquidation penalties in the market, ranging from 1% to 5%, with liquidity providers earning these penalties directly. This solution offsets the liquidity risk associated with certain yield strategies, allowing users to benefit from downturns during adverse market conditions. The Levva platform supports multi-chain access, including popular Layer 2 solutions and the Ethereum mainnet, ensuring broad compatibility and integration across the DeFi ecosystem.

If you are developing a yield-generating protocol that wants to utilize the Levva vaults, the protocol also offers a simple plug-and-play leverage module, making it easy to integrate the solution directly into partner protocols and decentralized exchanges (DEXs).

The DeFi industry, though still in its early stages, has revolutionized the access to and management of digital assets, significantly altering financial market dynamics. This sector has experienced rapid growth in decentralized applications (dApps), driven by liquidity management and lending protocols that offer immediate and leveraged liquidity to market participants. As DeFi continues to evolve, these applications must enhance efficiency, offer more advanced tools, and provide customizable risk management capabilities across fragmented blockchains. Addressing these needs is essential for the anticipated influx of institutional capital.

Levva, an innovative liquidity management protocol, offers a versatile and efficient solution for leveraging liquidity in the dynamic DeFi landscape. By simplifying liquidity management complexities, Levva caters to both lenders and borrowers with automated, risk-managed DeFi yield strategies. Its permissionless vault architecture provides diverse yield generation opportunities, while advanced borrowing use cases support sophisticated DeFi investment strategies. Addressing issues like liquidity fragmentation and risk management, Levva stands to enhance the DeFi ecosystem's efficiency and accessibility, making it a more appealing option for an advanced class of web3 investors.