Exploring the Rise of Liquid Restaking Tokens: Unlocking Liquidity in Ethereum, Bitcoin and Beyond

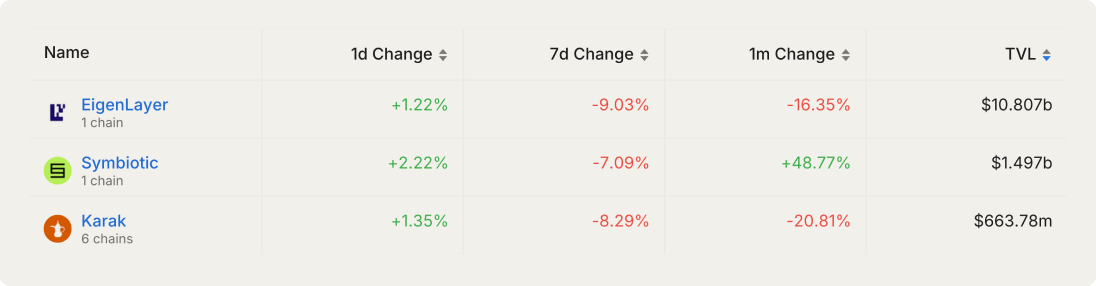

The restaking market is a hot trend in 2024, with EigenLayer leading the narrative for Ethereum restaking. EigenLayer has firmly established itself in DeFi and is responsible for the majority of the TVL in the restaking market.

However, new projects focused on restaking across multiple chains are quickly emerging.Some notable examples include Picasso (Solana restaking) and Babylon (Bitcoin staking), among others. We are also witnessing the rise and rapid growth in TVL of various liquid restaking protocols. The combined TVL of these, mostly Ethereum-based LRTs, has surged to an astonishing $15B since the start of the year!

In this research blog, we will take a closer look at the EigenLayer protocol and its competitors, analyze Bitcoin staking protocols, and examine liquid restaking protocols and LRTs. We will also observe some of the current trends and speculate on what these developments might bringin the near future.

Back to the Basics: Staking

To understand restaking better, let’s revisit the basics of staking. Proof-of-Stake (PoS) blockchains use their native tokens as a staking mechanism to achieve consensus and secure the network. PoS chains have a set of validators who propose and validate new blocks. Validators must stake the native token of that chain and, in return, they earn staking rewards in the form of new tokens (inflation) and fees.

If a validator misbehaves or engages in any type of malicious behavior, they may be “slashed,” meaning they lose a portion of their stake. This slashing mechanism incentivizes validators to act honestly. Naturally, the higher their cumulative stake, the more costly it becomes to launch a takeover attack on the chain.

What is Restaking?

Restaking, is an additional level of staking offered as a service. However, instead of securing the chain with your stake, you use it to secure other protocols by restaking your original stake.

As an example, EigenLayer allows Ethereum stakers to re-utilize their staked $ETH to secure applications built on top of EigenLayer. Stakers can choose which additional services they want to secure, earning an extra yield in the process By doing so, stakers grant EigenLayer additional slashing rights on their staked $ETH.

In essence, restaking allows staked tokens to be used again to provide additional security at the application level.

Key Ethereum Restaking Protocols

EigenLayer

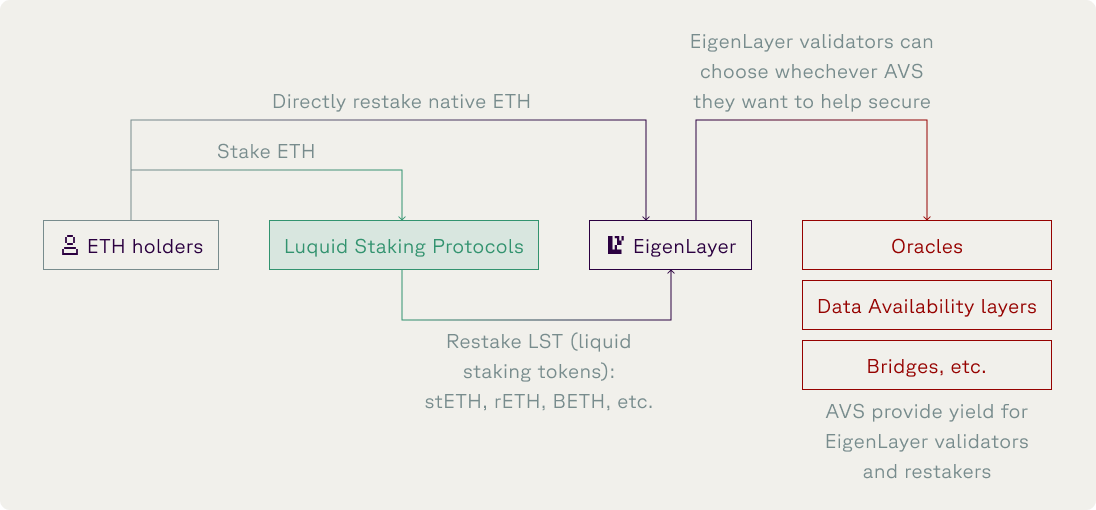

EigenLayer is the original staking protocol, holding ~80% of all TVL among EVM restaking protocols. Its closest competitor, Symbiotic, has $1.5B TVL staked, compared to EigenLayers $10B. The foundations of the EigenLayer protocol functioning are shown below:

There are three main categories of participants in the EigenLayer ecosystem:

- Stakers: Can stake $ETH or $LSTs to Eigenlayer to earn an extra yield, though at the risk of additional slashing. In most cases, stakers delegate their stake to Validators.

- Validators: Operators who run EigenLayer node software. Stakers delegate their stakes to node operators, who then validate Actively Validated Services (AVSs) and earn additional yield for doing so.

- Actively validated services (AVSs): Protocols that build on top of EigenLayer and seek to attract restakers to help secure their services. AVSs can range from new blockchains and data availability layers to virtual machines, oracle networks, and cross-chain bridges.

At its core, EigenLayer aims to enhance the capabilities of Ethereum’s infrastructure capabilities, and it will be interesting to see what types of newly Actively Validated Services (AVSs) emerge.

Projects on Eigenlayer

Here’s a table describing some of the notable projects launched on top of EigenLayer:

The full list of various AVSs can be found directly on EigenLayer’s website.

Symbiotic

Symbiotic is a shared security protocol designed to coordinate network security in a flexible and permissionless way. It allows network builders to control their own restaking implementation while benefiting from shared security arrangements. The protocol has five main components:

- Collateral: Represents various on-chain assets used for security, including tokens, validator credentials, and other positions across different blockchains.

- Vaults: Manage the delegation of collateral to operators across networks. These can be curated by liquid restaking providers or through operator-specific vaults.

- Operators: Entities running network infrastructure, such as validators or sequencers. They can opt into networks and receive economic backing from restakers through vaults.

- Resolvers: Entities or contracts that handle slashing penalties for operators. They act as arbitrators between security providers and networks.

- Networks: Protocols requiring distributed node operators for trust-minimized services, such as transaction sequencing or oracle functions.

Key benefits of Symbiotic include:

- Flexibility through modularity

- Risk minimization via immutable core contracts

- Capital efficiency through restaked collateral and reputation-based curation

The protocol aims to provide a credibly neutral and adaptable framework for shared security across various blockchain networks and assets. It has gained popularity in the past two months, rising to the top 2 restaking protocol, overshadowing Karak.

Karak

Karak extends staking further by offering a wider range of available services. One notable difference is that Karak allows staking across a broader range of assets, including Stablecoins and WBTC.

The Karak ecosystem consists of the following key components:

- Stakers: Can stake $ETH, $LSTs, $LRTs, and Stablecoins (USDC, USDe, FRAX, sDAI) to Karak smart contracts to earn extra yield, although this does run the risk of additional slashing.

- Operators: Are those that run Karak nodes. Stakers delegate their stakes to node operators, who then validate Distributed Security Services (DSSs) and earn an additional yield, which they share with Stakers.

- Distributed Security Services (DSSs): These are protocols built on top of Karak that seek to attract restakers to enhance their security. Similar to EigenLayer's AVSs, these services outsource their distributed security for a fee.

- Chains: Karak offers the creation of chains or rollups with out-of-the-box security features provided by their DSSs.

Projects interested in building on Karak can apply directly on their website. So far there are not that many DSSs. In June 2024, the first DSS project was released on Karak – Wormhole, a leading interoperability platform that facilitates the secure transfer of arbitrary messages across chains.

Liquid Restaking on Ethereum

When users deposit their $ETH or $LSTs to EigenLayer, they essentially forfeit their liquidity. Liquid restaking protocols aim to address this limitation by introducing another layer of wrapping in the form of Liquid Restaking Tokens ($LRTs). Users deposit their $ETH and $LSTs into protocols that manage staking on their behalf, and in return, these protocols mint $LRT for the users.

Top staking protocols are presented in the following table:

Bitcoin Staking

While restaking has largely been associated with the Ethereum ecosystem, the concept of shared security is also present on BItcoin. Below we will look at three notable protocols: Babylon, Stacks, and Botanix.

Babylon Protocol

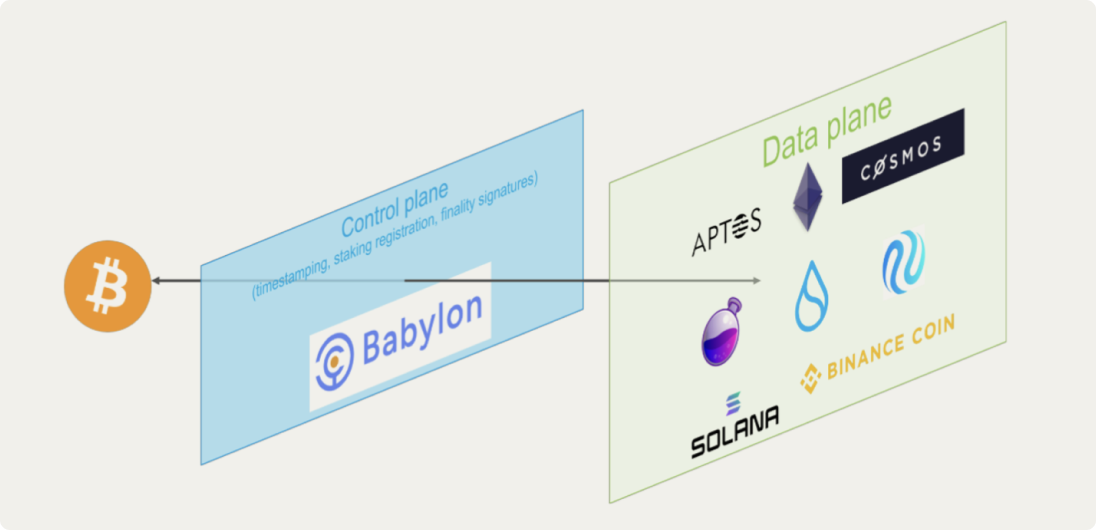

Probably the most notable protocol in this space is Babylon. Built on the Cosmos SDK, Babylon aims to leverage Bitcoins security to enhance the security of Proof-of-Stake (PoS) chains.

Babylon uses Extract One-Time Signature (EOTS) to convert slashable PoS attacks into spendable Bitcoin UTXOs, which are then used to burn Bitcoin. In Babylon, Bitcoin never leaves the BTC chain and is “staked” natively on the Bitcoin blockchain.

The core infrastructure of Babylon is a Cosmos-based blockchain that acts as a proxy chain between Bitcoin and PoS chains.

This so-called “control plane” blockchain is responsible for several key functions:

- It provides a Bitcoin timestamping service to the PoS chains, enabling synchronization with the Bitcoin network.

- It acts as a marketplace, matching Bitcoin stakers with PoS chains., andtracks staking and validation information, such as EOTS key registration and refreshment.

- It records the finality signatures for the PoS chains.

Babylon is currently integrating with the Cosmos Hub. Once integration is complete, Bitcoin holders will be able to delegate to Cosmos Hub validators to secure Cosmos appchains. These appchains will be able to select how their fees are split between ATOM and Bitcoin stakers.

Stacks L2

Stacks is a novel Bitcoin Layer 2 (L2) that utilizes the new Proof of Transfer (PoX) mechanism. Stacks uses its own token, STX, to secure the Stacks network, and writes its entire history on the Bitcoin blockchain. Similar to how Bitcoin PoW miners spend resources on electricity and are rewarded in BTC, Stacks PoX miners spend (already mined) BTC and are rewarded in STX.

Stacks is a non-EVM L2 with its own smart contract programming language called Clarity and a growing ecosystem of projects building on top of it.

Clarity is a decidable language (not Turing-complete), meaning that you can know, with certainty, from the code itself what the program will do – with code correctness verified by software. Clarity is an interpreted rather than compiled language, so the source code is visible on the blockchain for verification by humans. It also includes post-conditions that provide additional execution safety.

Botanix Spiderchain

Botanix Labs has created a Bitcoin L2 called Spiderchain. This L2 adopts the Rust implementation of the Ethereum Virtual Machine (EVM) to make life easier for Dapp developers.

Botanix uses a two-way peg bridge that enables users to transfer BTC back and forth between Botanix and Bitcoin. The bridged BTC is locked in multisig wallets secured by so-called Orchestrator nodes. A series of these multisig wallets make up the L2 Spiderchain, with a new multisig wallet created with every Bitcoin block. Botanix randomly selects a node to assign the new multisig wallet.Botanix uses the Proof-of-Stake (PoS) consensus model and leverages Bitcoin's inherent finality. Synthetic bitcoin is the native token of Botanix, pegged to BTC at a ratio of 1:1, and is the main element in the Botanix two-way peg system.

Botanix is currently in its testnet phase and is set to launch in Summer 2024. Its EVM compatibility makes it an ideal candidate for Dapp builders seeking to leverage Bitcoin security while using familiar development tools.

Conclusion

The restaking market has become a major narrative in 2024, with protocols like EigenLayer leading the charge. However, the landscape is rapidly evolving as new protocols across various blockchains emerge, offering innovative approaches to staking and shared security. From Ethereum's liquid restaking tokens to Bitcoin's integration with staking through protocols like Babylon and Stacks, restaking is expanding its reach and impact across the DeFi ecosystem.

As these protocols develop and mature, they have the potential to reshape how we think about staking, security, and yield generation in DeFi. Whether it's enhancing Ethereum’s infrastructure, introducing new security layers for Bitcoin, or expanding the range of assets that can be staked, the restaking trend is likely to drive significant innovation and growth in the coming years.